Similar products

Similar products

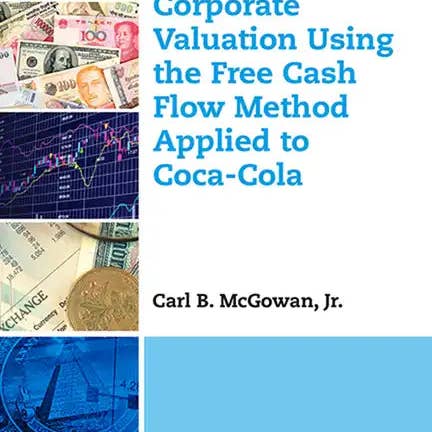

Wholesale Corporate Valuation Using the Free Cash Flow Method Applied to Coca-Cola - Paperback

WSP

$23.74 MSRP

Shipping & policies

- Estimated delivery Feb 6-17

Free and easy returns. Learn more

With Faire, shop unique wholesale products for your store from brands like Books by splitShops and more.

Description

by Carl McGowan (Author) The value of a corporation is the discounted present value of future cash flows provided by the company to the shareholders. The valuation process requires that the corporate financial decision maker determine the future free cash flow to equity, the short-term growth rate, the long-term growth rate, and the required rate of return based on market beta. This book provides a template for demonstrating corporate valuation using a real company-Coca-Cola. The data used in this book comes from the financial statements of Coca-Cola available on EDGAR. Other data are from SBBI, Yahoo! Finance, the U.S. Bureau of Economic Analysis, Stocks, Bonds, Bills, and Infla-tion, Market Results for 1926-2010, 2011 Yearbook, Classic Edition, Morningstar, and US Department of the Treasury. Number of Pages: 62 Dimensions: 0.14 x 9 x 6 IN Publication Date: October 15, 2014

Details

SKU: 9781631570292 Made in United States Weight: 99.79 g (3.52 oz) EAN: 9781631570292